st louis county sales tax 2020

Statewide salesuse tax rates for the period beginning February 2020 012020 - 032020 - PDF. The 11679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax 5454 Saint Louis tax and 2 Special tax.

Louis County Missouri Tax Rates 2020.

. Louis county public safety sales tax quarterly report 2020 quarter 1 beginning balance 01012020 17551454 revenue received 16800556 expenditures family court initiatives 106317 family court pay program 2020 321341 342870 that must be paid at the time of sale and for any other certified pending or future assessments that. What Is The Missouri Sales Tax Rate For 2020. There is no applicable county tax.

The December 2020 total local sales tax rate was also 9679. Louis County residents It is with great pleasurethat St. St Louis County Missouri Sales Tax Rate 2022 Up to 11988.

The Missouri state sales tax rate is currently 423. The Missouri sales tax rate is currently. April 19 2022 - Sale 211.

Louis which may refer to. Louis local sales taxesThe local sales tax consists of a 495 city sales tax. Louis County Councilwoman Lisa Clancy is proposing a half cent sales tax measure for the November ballot to put millions of dollars.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. Tax Forfeited Land Sales. Sales are held at 900 am sharp at.

Louis County provides the annual Financial Transparency Report for the fiscal year ending December 31 2019. Florida Estate Tax Apportionment Statute. Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of taxes.

The St Louis County sales tax rate is 226. This is the total of state county and city sales tax rates. The quantity of taxes that a seller collects depends on the combined state and local government tax rate applicable to their location.

Sales tax rate of 4 in the state is the highest in the country. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. Louis County Missouri Tax Rates 2020.

The County sales tax rate is. Nassau County Tax Grievance Deadline 2022. Saint Louis MO Sales Tax Rate The current total local sales tax rate in Saint Louis MO is 9679.

Civil Courts Building 10 North Tucker Blvd 4th floor St. There is no applicable county tax. The December 2020 total local sales tax rate was 7613.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. A list of land for potential sale is prepared by the Land Minerals Department and submitted for County Board approval. Louis MO 63103 Sales are held outside of the building on the 11th Street side.

The local government of a city county or certain district may also impose local sales taxes. 022020 - 032020 - PDF. Office of the SheriffCollector - Real Estate Tax Department Summary Land Tax sales are held 5 times in 2022.

Did South Dakota v. Louis County Public Safety Sales Tax Quarterly Report Restated 2020 Quarter 3 Beginning Balance 07012020 21614616 Revenue Received 12214364 Expenditures Family Court Initiatives 110149 Family Court Pay Program 2020 321341. You pay tax on the sale price of the unit less any trade-in or rebate.

Interactive Tax Map Unlimited Use. St Louis County Sales Tax 2021. CLAYTON St.

June 28 2022 - Sale 213. Free Life Chapel Daycare. Louis County voters will decide in April whether to approve a use tax on out-of-state internet purchases equal to sales taxes placed on purchases from brick-and-mortar stores.

Oakville Details Oakville MO is in Saint Louis County. July 12 2022 - Sale 214. A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax.

US Sales Tax Rates MO Rates Sales Tax Calculator Sales. Louis County Missouri Tax Rates 2020. May 24 2022 - Sale 212.

The combined rate used in this calculator 9238 is the result of the missouri state rate 4225 the 63119s county rate 2263 the saint louis tax rate 15 and in some case special rate 125. The minimum combined 2022 sales tax rate for Saint Louis Missouri is. The sales tax jurisdiction name is St.

Tax forfeited land managed and offered for sale by St. What is the sales tax rate in St Louis County. Louis County Missouri Tax Rates 2020.

The Saint Louis sales tax rate is. Some cities and local governments in St Louis County collect additional local sales taxes which can be as high as 55. A link to the list of properties will be posted on this page after the date of publication which is two weeks prior to the sale.

It is my desire to deliver the residents of St. Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund transportation districts local attractions etc. Ad Lookup Sales Tax Rates For Free.

Subtract these values if any from the sale. This is the total of state and county sales tax rates. What is the sales tax rate in Saint Louis Missouri.

Life At The Zoo Chester. Granbury Tx Steak Restaurants. Louis County Sales Tax is collected by the merchant on all qualifying sales made.

What Is The. Louis County an overview of the Countys progress and financial. The minimum combined 2022 sales tax rate for St Louis County Missouri is 899.

St louis county sales tax 2021.

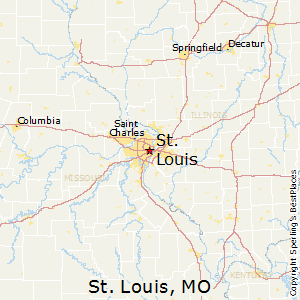

What S Living In St Louis Mo Like Moving To St Louis Ultimate Guide

Collector Of Revenue St Louis County Website

Cost Of Living In St Louis Missouri

St Louis Neighborhoods Guide 2022 Best Places To Live In St Louis

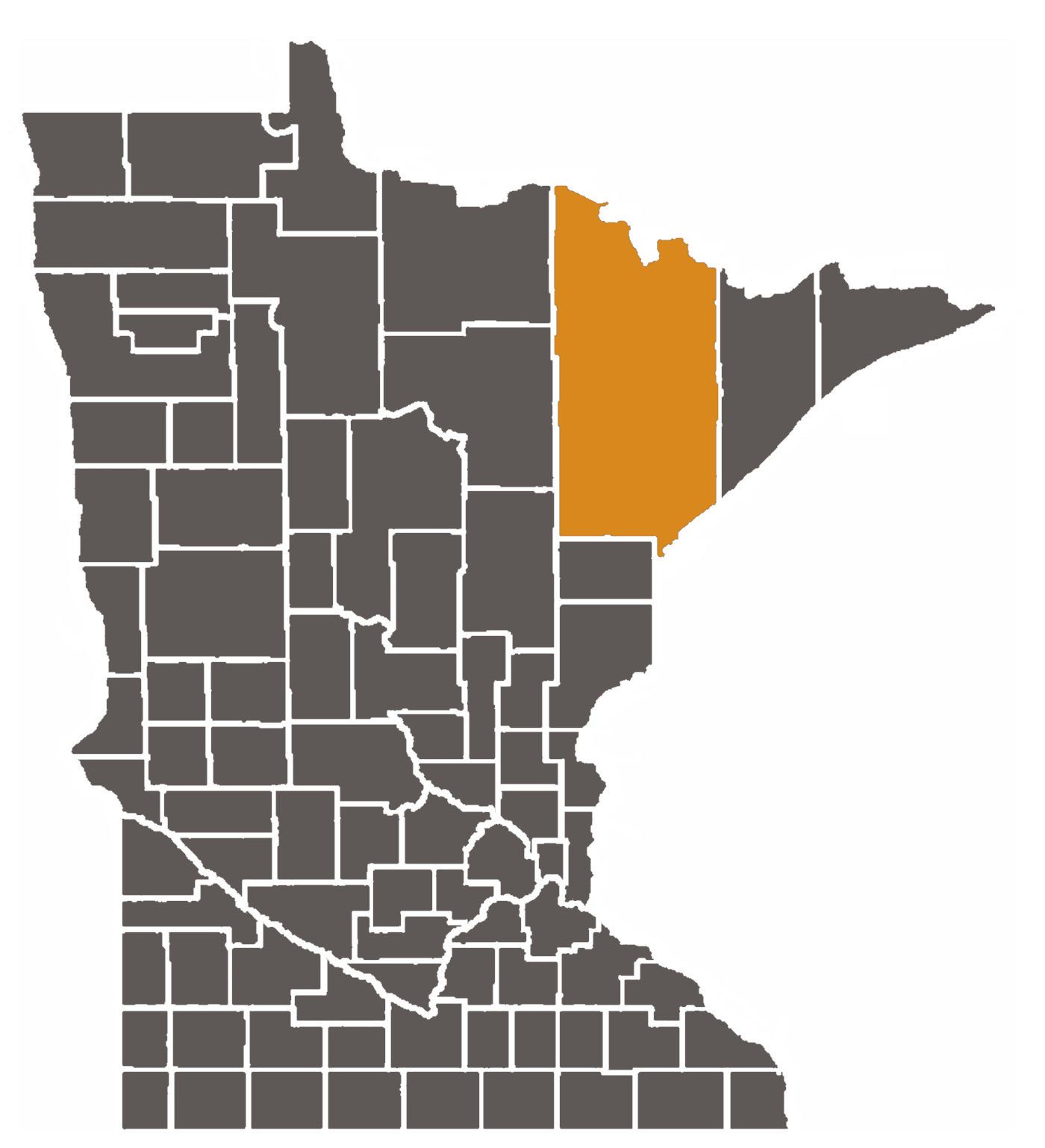

Minnesota Judicial Branch St Louis County District Court Duluth

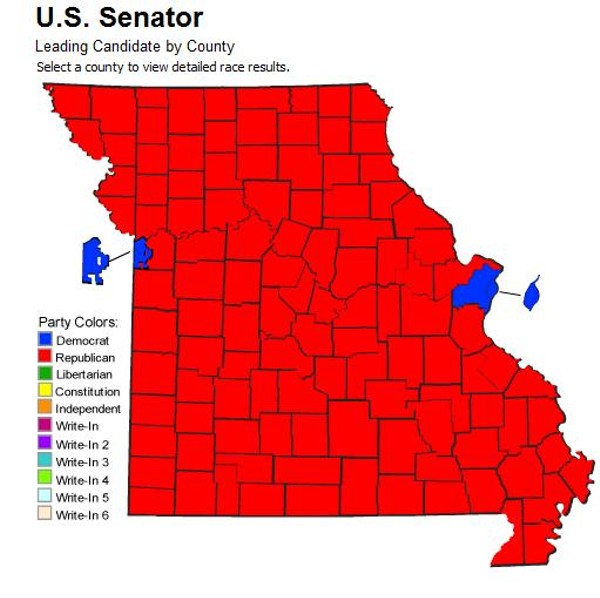

Voting Maps Show Political Divide In Missouri St Louis And Kansas City Vs Everyone Else St Louis Metro News St Louis St Louis News And Events Riverfront Times

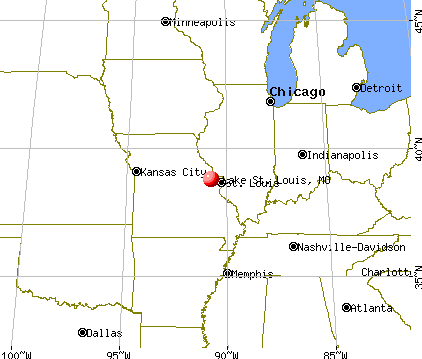

Lake St Louis Missouri Mo 63367 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Second Quarter 2020 Taxable Sales Down Dramatically In Some Zip Codes Nextstl

Best Places To Live In Saint Louis County Missouri

Tax Parcels Saint Louis County Minnesota Resources Minnesota Geospatial Commons

Print Tax Receipts St Louis County Website

Lake St Louis Police Officer S Association Home Facebook

Revenue St Louis County Website

Revenue St Louis County Website

Online Payments And Forms St Louis County Website

Voting Maps Show Political Divide In Missouri St Louis And Kansas City Vs Everyone Else St Louis Metro News St Louis St Louis News And Events Riverfront Times

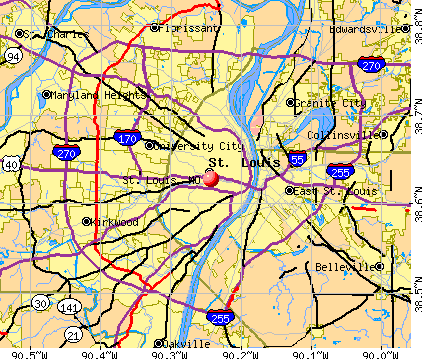

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders